The Remaining 15 Percent

I no longer had any official involvement with lululemon, but I still owned 15 percent and was its single largest individual shareholder. To be responsible to myself, the shareholders, and my family, I believed there had to be something I could do for the company. I wanted lululemon to achieve its full potential and regain its ability to elevate the world from mediocrity to greatness.

I wanted the business to function well, I wanted David Mussafer and Steve Collins to bring direction to the Board, and I even wanted Laurent Potdevin to succeed as CEO.

After selling to Advent in March of 2014, the share price had fluctuated wildly. The Board had believed lululemon’s issues were a function of growth, rather than culture and people development. The directors implemented more metrics because the company was losing its most knowledgeable people at such a staggering rate that they had been forced to operate by command and control.

Many of the core people had left, or were leaving. “We hit a few problems,” says Delaney Schweitzer, “Quality issues, et cetera, and the company and Board got scared and wanted to change things to play safe and take away some of the special things about lululemon to become more of a typical retailer. It became obvious in 2014 that the Board always felt external talent needed to be brought into senior roles at lululemon. My ultimate reason for leaving was that maintaining the unique culture and the brand essence of lululemon was less important to the Board than managing the short-term earnings.”

“I gave my notice on May 1, 2015,” says Deanne Schweitzer. “My sister had also given notice. I wasn’t being challenged any longer, and my whole body told me I couldn’t do it anymore.”

As Michelle Armstrong recalls, “I was VP of womens and accessories global merchandising. But it had gotten to a point where there were too many people at the senior leadership level who never understood why we did what we did and didn’t appreciate what made us unique and successful. I felt like I could fight for our old way of doing things, but I might be fighting for the next 10 years, and I wouldn’t win. Or I could bow out while I was still optimistic about the company.

“Just before I resigned, I thought, ‘Lululemon looks like every other retailer out there now.’ I think it’s all out of fear. The risks we used to take in breaking the retail model, and breaking the way products load to a store, and breaking the way you build a line plan, and doing it the way we felt was best for the Guest. . . it was just a different way of working. But people sometimes think “different” is bad. Or unsafe. And I think we just slowly became like every other organization. I was sad to see it happen. It didn’t need to be that way.”

Worse yet, it appeared quality people did not seem to want to work for lululemon, and Laurent was hiring disgruntled Nike people. As with Christine, Laurent was not a leader who could teach and develop people below him so the law of attraction worked the opposite way. Nike people brought constructs opposite to those on which lululemon was built. Laurent was building a wholesale management team for a vertical model. Two different models in one company would only stop the flywheel. It was the blind leading the blind.

As George Tsogas, the former VP of Global Logistics and International Distribution, observes, “The Board had hired a CEO that was not a cultural fit, hence why all of Chip’s cultural programs were removed from the business to enhance bottom lines for short-term gain. This risked the formula that made lulu- lemon so great to begin with.”

Virtual AGMs

I could not buy or sell lululemon shares without issuing a press release, and I chose not to attend lululemon’s 2015 AGM. I wrote letters, and I asked insightful questions at successive AGMs; questions I believed if the Board discussed and answered could have added billions to lululemon’s value.

In their brilliance, the Board instituted virtual AGMs in 2016, which enabled the Chairmen, Michael Casey and David Mussafer, to pre-screen questions. Obviously, by not asking a question that had been posed by a shareholder, they were deciding not to answer all shareholders. When lululemon’s Chairmen allowed integrity to lapse, it was no wonder the company was unable to attract a CEO of integrity.

If vision, brand, people development, and innovation could be measured the same way as financial auditing, lululemon would be knee-deep in litigation.

Before the 2017 AGM, Glenn Murphy and David Mussafer, as co-chairmen reached out to talk to me. I did not wholly trust David because in my view, he had conspired with Michael Casey not to answer my 2016 virtual AGM questions. I did not know Glenn Murphy well, but he was separately incentivized by Advent and therefore definitely not independent. I had to wonder if their desire to talk to me before the 2017 AGM was another way to silence me (during a long stretch of underperformance and with another lousy CEO at the helm). I concluded a private conversation would not be fruitful. How could I know what Glenn and David would say was a lie and what was the truth?

The reason I dropped off the Board was that I had no internal credibility after the Christine Day era. I made the decision to step down so I could use the public forum to expose the Board’s poor long-term performance, archaic governance practices, and lack of integrity. It seemed to me I could continue to be more effective outside of the Board than from within.

In retrospect, I could have met David and Glenn, but my failure at lululemon was the result of trusting conflicted directors. Both David and Glenn were driven by short-term gain and would say what- ever they needed to say to convince me of their long-term vision. I had already seen lululemon’s long-term interests sold out by Advent when they incentivized Bob Meers to build too many US stores too quickly in 2007 and 2008.

In turn, I chose not to trust them (using that critical distinction between deciding and choosing). I had no emotion around my choice. I understood I was of two minds. One was as the emotional founder and deepest lover of lululemon. The other as the long-term business investor. I had come to realize that I needed to think like an investor.

Can I get over this now? Certainly. I can choose to be a collaborator and work with a team. I believe I am much smarter about people and their motivations than I was as a neophyte board person. I also know enough to understand most directors do not know very much about the actual workings of the company.

As a result, I don’t necessarily have to defer to ideas that were learned from another business. There is marginal correlation between other companies and a vertical technical apparel company like lululemon.

It is a sad world in the public realm when the largest and most informed shareholder can be ignored at virtual AGMs so the directors can save face. It’s a sad world when the SEC will not enforce the one time each year that shareholders have a right to question operations.

My questions for the 2016 and 2017 AGMs were ignored and went unanswered. They were direct and pointed out the core issues at lululemon – but, of course, they also pointed out director incompetence and therefore, were embarrassing. However, they were also questions that as a board member, I would have posed and had answered which could have added billions to lululemon’s market capitalization.

To the Board’s credit, changes to directorship were made in 2017, resulting in a big shift. These included bringing in Jon McNeill from Lyft, Tricia Glynn from Advent, my nominee Kathryn Henry, and Glenn Murphy, the former CEO of the Gap. Glenn was brought in as co-chairman as an obvious backup to a problematic CEO. Michael Casey was removed as chairman (although, as of this writing, he remains on the Board).

At the 2018 virtual AGM, I submitted three questions and one further question was sent in by an- other shareholder. Glenn Murphy, as co-chairman with David Mussafer, answered one of my questions and the one from the other shareholder. He then went on to say, “We only received two questions, two questions are all we have.” Glenn blatantly lied to the shareholders.

Obviously, if Glenn could lie at such a public forum, I would have to assume anything he says is a lie. Since other board members knew Glenn was lying, one can only surmise they too could not be trusted. (Make your own assessment by listening to the 2019 Annual General Meeting, including the answers to shareholders’ questions at the end of this book and on chipwilson.com.)

Proof of Board Incompetence

In an article for the New York Times (published, oddly enough, just days before lululemon’s first virtual AGM), corporate law professor Steven Davidoff Solomon bluntly stated that virtual shareholder meetings are “a bad idea as it lets a company deal with troublesome shareholders and their often-uncomfortable questions, since the people running the meeting can privately view and manage shareholder questions without broadcasting to other attendees.”1 Solomon talks about virtual AGMs where the shareholder Q&A portion is handpicked, and how the Council of Institutional Investors staunchly opposes virtual AGMs.

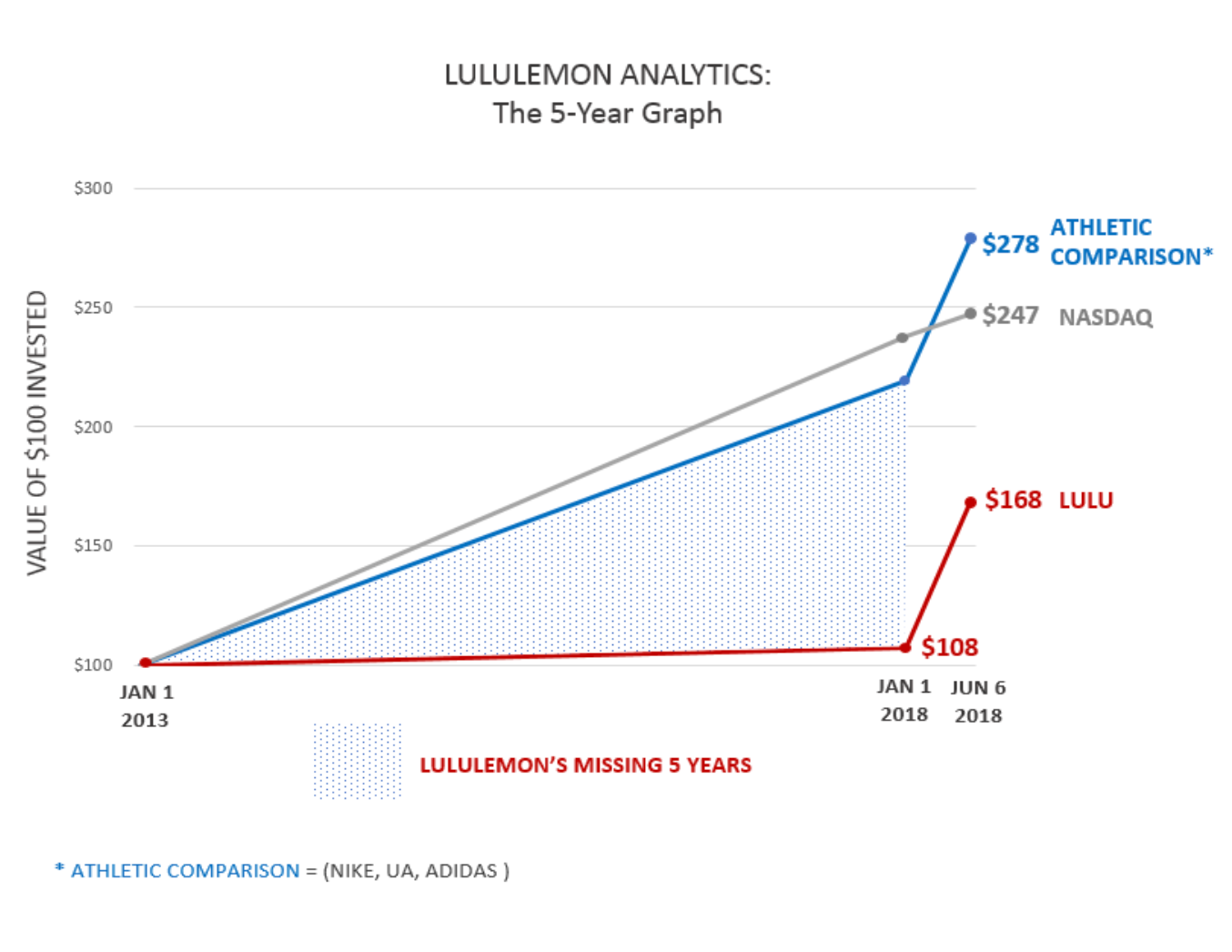

I could never convince the Board of how poorly the company was being run, especially from 2011 to 2017. The only possible metric to prove the non-quantifiable aspects of the business (brand, product, and culture) is a five-year graph comparing lululemon to a basket of athletic companies and the stock market. From January 1, 2013 to January 1, 2018, lululemon stock grew from $74.02 to $79.69. This was an annualized return of 1.49 percent. Other stats for the same period were 16.98 percent for athletic competitors (Under Armour, Nike, and Adidas), and 18.95 percent for the NASDAQ.

Put another way, if you had invested $100 over that same period (January 1, 2013 to January 1, 2018) you would have profited $8 from lululemon. Conversely, that same $100 investment would have netted you an average of $119 from lululemon’s athletic competitors and $138 from the NASDAQ.

As lululemon missed out on the most significant five-year growth in the technical apparel industry, one can extrapolate on its value going forward. People think lululemon performed phenomenally well from 2018 to 2021, but it’s important to note that this increase was based on a very low starting number to begin with as lululemon stock value had been stagnant for five years. Any increase over a small number looks like a large percentage increase. Had lululemon continued its meteoric rise from 2011, lululemon’s increased valuation to 2021 would have been only average. Consequently, even though lulu- lemon’s current value in early 2021 is $41 billion USD, one could say lululemon will always be worth half of what it could have been. And yet, I surmise the Board will ensure accolades, plaques, and speeches will be made for those directors (Marti Morfitt, Glenn Murphy, Michael Casey, Emily White, David Mussafer, etc.) who were responsible for the massive loss. Of course, he who wins the war gets to write the history.

Many people find it incredulous that when asked about the $45 billion value of lululemon in 2021, I say it should be worth double. My point here is that Jeff Bezos refused to give in to analysts who wanted Amazon to stop investing and to start showing a profit. Had Bezos stopped investing in Amazon’s growth, it would be worth half its present $1.4 trillion dollar value and people would still think it was a great company. In the same way, lululemon’s directors failed its investors for five years and will only ever be worth half its possible market capitalization ad infinitum. To be clear, people who think lululemon fulfilled on its potential simply cannot fathom all the possibilities of what could have been.

Had lululemon advertised at the right time, moved into mindfulness, bought into 50 percent of their production capacity, gone global in 2011 (especially in China), maintained its people development platform and fulfilled on men’s being a billion dollar business by 2015, lululemon would have been a $100 billion dollar business by 2020.

Knowing lululemon was in for a long term flat or declining stock value in 2013, I was conflicted about what to do with my lululemon stock. I was best to sell and invest elsewhere, but if I sold stock, I would incur a massive 25 percent tax bill. My founder’s stock sale would have instigated a mandatory public announcement, which would have scared other shareholders, who in turn would have sold, and thereby sent the share price down. It’s the worst situation and definitely something private equity firms don’t want founders to know about.

No one understood the athletic businesses as well as I did. What was tremendously ironic during the 2013 to 2017 years was that because I understood the business so well, I made money by buying and selling Under Armour and Nike at opportunistic times. Imagine the founder of lululemon investing in competitors because he had lost belief in the directors and CEO of the business he had founded.

Stock Value Increase

A rising tide lifts all boats. The last half of 2017 to the end of 2020 created one of the biggest stock value increases in North American history. If one were to look at lululemon’s performance over only these thirty months, it would be seen as amazing. Inside of a longer time frame however, it could only be seen as good.

One would ask, was lululemon’s increase in market capitalization a result of the long-term strategy by the Board of Directors or was it the result of other mitigating factors, such as:

- Investors determined lululemon would survive the Amazon effect.

- The directors implemented a massive stock buy-back, pushing the stock price up.

- The American economy was on fire and consumer spending was at record rates.

- The Federal Government reduced corporate taxes to near-record lows in instant above-projection profits. The low tax rate attracted international investors to US stocks, creating unprecedented demand.

- My strategy, to change board dynamics to infuse lululemon with new directors with the goal of replacing its inappropriate CEO, worked.

- The fundamentals upon which the lululemon business model were based are still alive and working well, and lululemon naturally emerged from of a five-year hole.

- Under Armour went through a collapse in early 2017 and other athletic companies took market share. The share value of all athletic companies rose dramatically in these 30 months.

Imagine This

If the directors of a public board were mostly visionaries and creative brand or product people, the company would have tremendous brand presence and provide innovative, high-margin products. This type of one-sided director will have trouble getting the product to market and counting money in an appropriate way. A “creative” board provides a value multiplier of one. Conversely, if a board is comprised of operators and financial experts, the company will excel at counting its money, but will have no context for the effect on sales and profits that an innovative product and differentiated brand strategy could have. This type of board also provides a multiplier of one to the management and company value.

However, if creative product people and financial operators could appreciate the intelligence that each contributes, the company would see a synergistic multiplier of three.

In February 2018, a rise in lululemon’s stock created a PR opportunity for lululemon to “let go” of its CEO, Laurent Potdevin, without triggering instability in share value or embarrassing its directors. By that time, eight years had passed since the Board of Directors failed to fulfill its number one job of ensuring appropriate leadership and a leadership pipeline. Running lululemon without a CEO that the company could command and deserve cost the company $18 billion in value in my educated opinion.

Glenn Murphy, as Chairman, publicly stated that lululemon was committed to finding a CEO who was a cultural fit. To find that cultural fit, I feared that the Board would simply redefine the culture. They could change the culture to suit the needs of their star candidate, and then support that change by claiming that the culture needs to evolve as the company grows.

The challenge is that culture needs to be embraced from the top down - everyone needs to be aligned.

Letting go of Laurent provided lululemon with a great opportunity. Lululemon needed an athlete who understood the nuances of the West Coast culture as the CEO – a person who understood how to physically push through barriers.

In many ways, lululemon has created its own way to survive, just as individuals do. In lululemon’s case, it decided to survive by not rocking the boat, not risking and never sticking its neck out. What lululemon received from this survival mechanism was incremental growth with no bumps. Operating this way ensured there was no need to engage with fringe social media, litigation was minimized, and institutional shareholders were not shaken. To outsiders, it looked as though lululemon had adult supervision.

On the other hand, there is a lot lululemon did not get from its survival mechanism. It didn’t get entrepreneurial-inspired employees or new top talent who were looking to be mentored by superior management. It did not get the opportunity to learn from mistakes and adjust accordingly. Lululemon did not get breakout ideas because they were deemed too risky. In short, the company is simply “good” and under the Chairmanship of former Gap CEO Glenn Murphy, I couldn’t imagine lululemon becoming anything other than another GAP.

Employees

Integrity starts at the top. I look forward to a time when the directors and employees have the same standard for integrity. If the last three chairmen of the Board can disclaim, avoid, and reframe questions of a shareholder at a virtual AGM, then they can and will do the same to their employees.

The employees know this. This is how a lack of integrity works. A good result cannot come from unethical actions. Thus, lululemon’s directors could choose integrity as a way to better profits while doing the right thing for employees and customers.

One of my reasons for writing this book is my deep commitment to the employees who built lululemon and contributed to the creation of an extraordinary and unique company and culture. It’s important that they understand how directors in a public company are often unable to see, and unfortunately, are almost never interested in the reasons these employees came to the company in the first place. I know the employees of lululemon may not get the whole picture. Perhaps too much time has passed. Perhaps the poor leadership has onboarded too many people at the head office level who do not have the context to know what “great” is. Few are left with the knowledge to train new people, enshrine the Operating Principles or promote the culture.

Employees deserve to understand the level of influence directors have over the culture and integrity of a company. They should also have the opportunity to experience the possibilities that are created when a board aggressively supports and nurtures the culture of that company. Employees deserve to know the difference between a vision based on metrics set out for Wall Street and a vision based on ideas set out to change the world.

Diversity and PR

There will be media who want to ignore long-term stock returns, but these are the very media that support inconsequential short-term gains through meaningless press coverage. I think it would be prudent for the Board to spend an hour discussing and reflecting on the lost five years so that history will not repeat itself.

Our shareholders, employees, and Guests suffered, but they will never know what was possible. Lululemon has the ability to deliver innovation to Guests before they know they want it and provide the intangible gifts which long-term thinking allows – gifts that build competitive moats, build brand, create superior margins, and keep extraordinary people motivated. It would be incredible to see lululemon expand its business with its billion dollars in cash rather than continuing to buy back stock. Buying back stock is a last resort of the unimaginative.

Just as short-term parties have played their strategies to profit from lululemon, this book is my request for the Board to consider growth-minded directors who take a different route to work each day. Directors who can shrug off sensationalized media and listen only for what is important to our iconic customer. Directors who will hire and incentivize management for the long run.

Attracting the right diversity of directors is an arduous job, as creative people or visionaries do not want to participate when trailblazing ideas are dampened. The best solution is to figure out how to attract creative people, crazy enough to be public company board directors. They could be the creative founders of companies lululemon may acquire. It is well documented that public companies with founders produce significantly more value than those who do not.

I have reframed my interpretation of directors and top management. I now consider these people as entrepreneurs who are doing all they can to build their personal brand and wealth. They create their wealth not by creating a concept of their own but by knowing when and how to piggyback on others. So, a founder’s job is to funnel the directors self-interested, entrepreneurial drive for the good of the company. Governance and financial parameters must go hand in hand with directors and top management.

My success in life has come from my appreciation of those who think differently from my growth mindset. In today’s world of social media, I may be considered to be a liability, but the pendulum may shift back to people wanting authenticity instead of a protected PR shield. To find gaps in the marketplace, I am continually challenging the status quo of society, politics, relationships, and apparel. Part of my process is to think out loud. Those attached to the status quo may not always agree with me.

Lululemon directors may continue to defend their oversight of the company because this story will not enhance their short-term interests. As you might imagine, I have no close friends at Coke, Pepsi, within the NY fashion media, Wall Street analysts, nor the lululemon board of directors. It is in their best interest to ensure this book does not succeed as it conflicts with their reputations and profits. These entities have massive PR machines which, within the realm of conspiracy theories, are incentivised to undermine this book.

In many ways, this is a great system. Lululemon directors enhance their reputations, the PR consultants get paid to write stories the directors want, business reporters use these free PR stories, and the media outlets get low-cost content. It’s win-win - unless you care about the truth.

I want the conclusions in this book to reset the lululemon foundation, however, change takes time, patience, and investment. If employees had acted in the same manner as lululemon’s directors, they would have been fired. As I’ve already demonstrated, lululemon’s governance model protects the directors from the level of accountability to which they hold employees. This self-perpetuating mediocrity risks putting the company into another dark period. The years of 2013 to 2018 were only a setback for lululemon. It was a failure from which to learn.

In July 2018, lululemon announced Calvin McDonald as its new CEO. What is exciting about Calvin is that he is an athlete, and this could be a great start of a new era. What is unnerving about Calvin is that he is a Glenn Murphy protégée and, on the basis of the law of attraction, his operating motives are suspect.

2021 and Beyond

I urge lululemon employees to be careful around the directors. They are slippery and deceptive and will pretend to support you and to back you up. The lululemon directors have succeeded in life by being political survivors and liars. Beware of any plaque put up in the hallways celebrating “long term” directors. If anything is put up on the office walls, it should be to recognize and celebrate failures, so the same mistakes do not occur again. Unfortunately, the law of attraction will kick in and the current directors will attract subsequent directors who will support status quo.

In May of 2019, lululemon announced that my representative on the board, Kathryn Henry, would become a lululemon appointee and would stop being my representative. This was a long time coming as Kathryn knew the board had declined to answer my AGM questions and was implicit in Glenn Murphy’s lie to the shareholders in the 2019 AGM. Like most people who claim to have integrity, Kathryn was adamant she was a person of integrity until she was faced with a real dilemma. Kathryn knew I would remove her as my board representative for failing to do her job to ensure all shareholders’ questions were answered and if answered, then, properly answered.

In May of 2019, lululemon stripped me of my board seat for not adhering to my agreement with Advent and the board. This was an agreement that was put in place to curb unfounded attacks on the directors and company. The agreement allows me to make business observations and comment as I see fit. The board has taken the position that I am in violation of the agreement and I have until August of 2021 to litigate. This will be a terrible waste of shareholders’ money; however I cannot envision myself on the lululemon board ever again due to my investments in multiple other athletic companies.

In summary, the board first marginalized me from the board by setting up a separate sub-committee due to their conflicted interpretation of my son and wife running Kit and Ace. When I stepped off the board in February of 2015, I did so to free myself to ask questions of governance and business direction at AGMs. In reaction, the board instituted virtual AGMs. In these virtual meetings, the board cherry-picked the questions they wanted to answer, and what they did answer had little relevance to the questions. Then, Glenn Murphy lied to shareholders during the 2019 AGM.

So, I would assert that, given my commitment to lululemon’s success and to change the archaic board structure, I was met with a preponderance of evidence of deception and lies. Lies and deception made from a need for personal survival. I have a right to go public and to write this book as the only conduit remaining to ensure lululemon does not slide into becoming the next GAP.

I am still lululemon’s single largest shareholder and I remain a cheerleader for its success.

Everything I Touch Turns to Gold (70% of the Time)

In 2019, our family sold Kit and Ace to its employees as I had failed in my goal to build a billion-dollar company in five years. In my failure to succeed at this goal, I had brought division and mistrust inside of my family. I lost a lot of money. However, my family now works well together, and we know what very few others do - we have knowledge of what to do or avoid when trying to build a billion-dollar company in five years.

I spent 20 non-profitable years working on my Westbeach MBA to attain critical knowledge to build lululemon. Our family learned three critical bottlenecks in failing to build a billion-dollar company in five years:

- Before getting into business with family members, have a clear governance structure for accountability. There has to be only one person with the final say.

- Culture needs time to grow organically. Build a fast-growth company with only a few employees, contract out everything viable, and use Artificial Intelligence, Virtual Reality and Augmented Reality.

- Too much money thrown at growth diminishes employees’ abilities to creatively solve problems. Constricted money flow actually produces a stronger company.

Many poker games are won by knowing when to fold the cards.

The future I want to create is a company with integrity at the top. A company where public quarterly meetings are truthful, and the CEO can answer questions without fear of short-term ramifications. A company where leaders create leaders. A company with a diverse board that appreciates both fixed and growth mindsets. A company where athletes drive brand, product, and innovation. My dream of being a partner in the world’s number one technical apparel and running shoe company led by people development is very attainable. That company is Amer Sports, and I get up every day excited to support whenever requested to do so.

Good is the enemy of great.

- Steven Davidoff Solomon, “Online Shareholders’ Meetings Lower Costs, but Also Interaction,” The New York Times, June 1, 2016, https://www.nytimes.com/2016/06/01/business/dealbook/online-shareholder-meetings-lower-costs-but-also-interaction.html?emc=edit_ dlbkpm_20160531&nl=%3Fnl%3Ddlbk&nlid=51768508&_r=0.